📌 This is Part 2 of a 2-part series: ← Part 1: Economic Analysis Part 2 (this post): Manufacturing, regulatory, and physical constraints

Last Updated: February 5, 2026

⚠️ Accuracy Disclaimer: This analysis synthesizes data from regulatory filings, manufacturing precedents, and aerospace industry reports. While we’ve made every effort to verify production rates, regulatory approvals, and physical constraints, the space manufacturing landscape evolves rapidly. Launch capacity numbers reflect current FAA approvals as of February 2026. Timeline projections are based on historical precedents from Tesla, Apollo, and Starlink programs. Readers are encouraged to verify critical details independently.

Introduction: When Economics Isn’t Enough

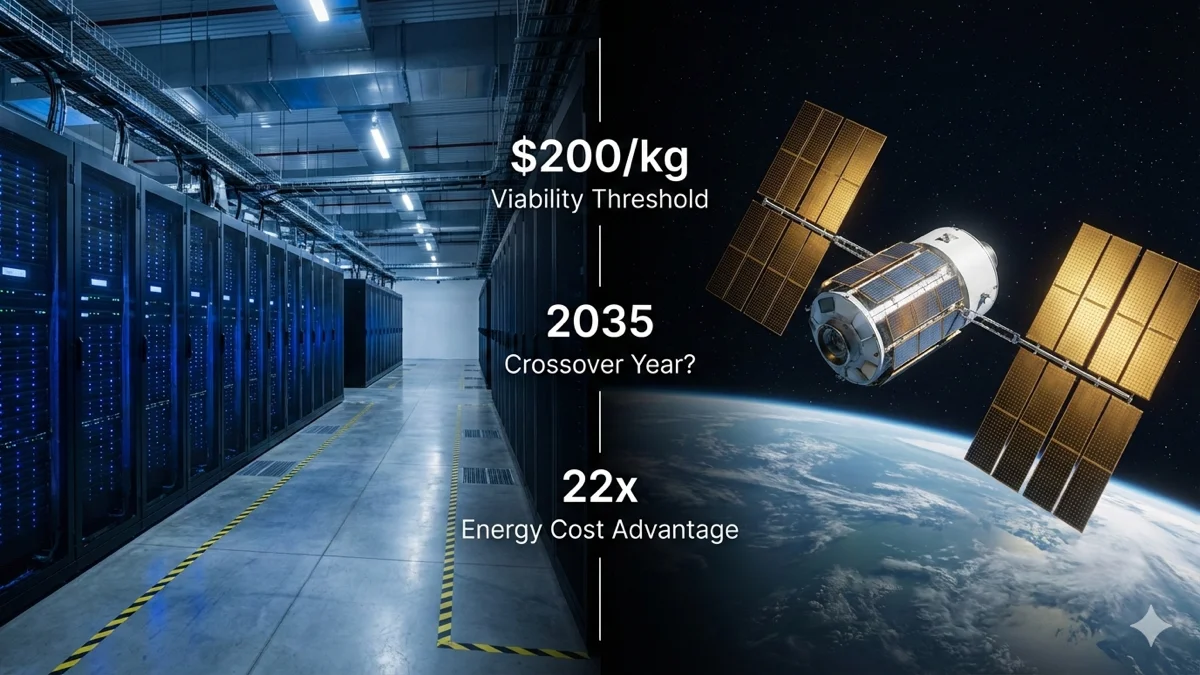

In Part 1, we explored the economic viability of space-based AI data centers. The conclusion: if launch costs drop to $200/kg, space becomes economically competitive around 2035.

But there’s a critical caveat buried in Elon Musk’s claim that “within two to three years, the lowest cost way to generate AI compute will be in space.”

Even if Starship achieves $10/kg launch costs tomorrow, the physical and manufacturing constraints make Musk’s timeline impossible. This is the untold story: physics, not economics, is the binding constraint.

This post examines why Musk’s “1 million satellites in 2-3 years” represents a 5-10x underestimate of the actual timeline, and why even unlimited capital can’t compress decades-long manufacturing realities into years.

The 1 Million Satellite Problem: Physical Constraints Trump Economics

The claim: SpaceX filed with the FCC to launch “up to 1 million satellites” for the “SpaceX Orbital Data Center System”

The math problem: Even if Starship achieves $10/kg launch costs tomorrow, the physical logistics make Musk’s timeline impossible.

Launch cadence requirements:

Assuming optimistic satellite packing (100 satellites per Starship launch):

- 1 million satellites ÷ 100 per launch = 10,000 launches required

Timeline at different launch rates:

| Launch Cadence | Time to Deploy 1M Satellites | Feasibility |

|---|---|---|

| 69/year (current Starship capacity) | 145 years | All Starship sites at max capacity |

| 500/year (7x current Starship rate) | 20 years | Requires unprecedented regulatory expansion |

| 1,000/year (ambitious scale-up) | 10 years | Would require 2-3 launches per day, every day |

| 3,300/year (Musk’s 2-3 year timeline) | 3 years | Requires 9 launches per day—physically impossible |

| 8,760/year (Musk’s peak capacity goal) | 13 months | 24 launches/day—Musk’s 2031-2032 timeline |

Musk’s Own Timeline Contradiction:

On August 24, 2025, Elon Musk predicted: “In about 6 or 7 years, there will be days where Starship launches more than 24 times in 24 hours.” This puts extreme launch cadence at 2031-2032.

Yet in February 2026, with the SpaceX-xAI merger announcement, Musk claimed orbital data centers would become “the lowest cost way to generate AI compute” “within two to three years” (2028-2029).

The internal inconsistency:

| Timeline | Musk’s Claim | Capacity |

|---|---|---|

| 2028-2029 | Orbital data centers dominate | Requires ~3,300 launches/year (9/day sustained) |

| 2031-2032 | 24 launches/day peak capability | Could support ~8,760 launches/year |

| Gap | 3-4 years | Launch capacity lags deployment claims |

What this reveals: Even Musk’s own public statements show a 3-4 year gap between when he claims orbital infrastructure will dominate (2028-2029) and when he admits launch capacity will reach extreme levels (2031-2032). If 24/day is “peak” (not sustained), sustained 9/day for 1M satellites would realistically arrive even later—mid-to-late 2030s.

Key insight: Musk’s later admission (Aug 2025) that extreme launch cadence is 6-7 years away directly contradicts his earlier claim (Feb 2026) that orbital dominance is 2-3 years away. This isn’t speculation—it’s timeline slippage in Musk’s own projections.

Regulatory reality check:

Current approvals total 69 Starship launches per year across SpaceX’s two Starship-capable sites:

- Kennedy Space Center: 44 Starship launches/year (approved January 2026)

- Boca Chica/Starbase: 25 Starship launches/year (approved May 2025)

Note: Cape Canaveral SLC-40’s 120 launches/year approval is for Falcon 9 only, not Starship. Falcon 9 cannot carry data center satellites, so this capacity is irrelevant for the 1 million satellite deployment.

What expanding to 1,000+ launches/year requires:

- Environmental reviews: 2-5 years per site for new/expanded facilities

- Range safety infrastructure: Tracking systems for unprecedented launch cadence

- Airspace coordination: FAA must close commercial flight paths 1,000+ times annually

- Orbital debris management: Adding 1 million satellites would 10x the current on-orbit population (~9,400 Starlink satellites as of 2025)

- International coordination: ITU frequency allocation for potentially the largest satellite constellation in history

Manufacturing constraints:

SpaceX currently produces:

- Starships: ~1-2 vehicles per month = 12-24 per year

- For 1,000 launches/year: Need 83 launches per month (assuming 12-flight reuse)

- Required production: ~7 Starships per month minimum

Even if each Starship achieves 70 flights (Musk’s target), deploying 1 million satellites in 10 years requires:

- 10,000 launches ÷ 70 flights per vehicle = 143 Starship vehicles

- Current production: 12-24 per year

- Timeline: 6-12 years just to build the fleet

Satellite production scale:

Starlink satellites (for comparison):

- Production rate: ~1,000-1,500 satellites per year currently

- Total deployed: ~9,400 satellites (as of late 2025)

- Time to produce 1M satellites at current rates: 660-1,000 years

For 1 million data center satellites in 10 years:

- Required production: 100,000 satellites per year

- Required scale-up: 66-100x current Starlink production

Data center satellites are more complex than Starlink communication satellites:

- Computing hardware (GPUs/TPUs)

- Thermal radiators (dominant mass)

- Solar panels (larger than Starlink)

- Each satellite likely 5-10x the complexity

The Automation Myth: Why Robots Can’t Compress Timelines:

A common response to manufacturing constraints is: “Can’t automation solve this?” It’s a fair question—SpaceX already uses extensive robotics, and Elon Musk famously applied Tesla’s “machine that builds the machine” philosophy to Starship production.

What automation CAN do:

Modern manufacturing automation can deliver significant improvements:

- Starship production: SpaceX uses robotic welding, automated stacking, and precision assembly

- Current: 12-24 vehicles/year with partial automation

- Best-case potential: 50-100 vehicles/year with fully automated factories

- Improvement: 2-4x efficiency gain

- Satellite assembly: Current Starlink production (~1,500/year) already uses significant automation

- Best-case potential: 10,000-20,000 satellites/year with dedicated mega-factories

- Improvement: 7-13x efficiency gain

What automation CANNOT solve:

Even “lights-out” factories (fully automated, zero humans) face insurmountable constraints:

1. Supply chain bottlenecks:

- Specialized materials can’t scale instantly:

- Carbon fiber composites (Starship structure)

- Radiation-hardened electronics (satellite computers)

- High-efficiency solar cells (power systems)

- Rare earth elements (magnets, electronics)

- Reality: Supplier factories take 3-5 years to build and scale

- No amount of robotics at the assembly plant helps if parts don’t arrive

2. Quality control time is physical, not labor-limited:

- Aerospace testing requirements:

- Thermal-vacuum chamber: 1,000+ hours per satellite batch

- Vibration testing: Simulating launch stresses

- Radiation exposure validation: Cannot be accelerated

- Systems integration: Each satellite needs powered testing

- Reality: You can’t “speed up” a 1,000-hour test with more robots

- Example: SpaceX Starship development—even with unlimited automation, each test flight requires weeks of analysis

3. Capital deployment time:

- Building automated factories takes years:

- Factory design: 12-18 months

- Construction: 18-36 months

- Commissioning & debugging: 6-12 months

- Total: 3-5 years per facility

- Reality: Can’t build 100 factories simultaneously—need to learn from first one

- Can’t spend $100B effectively in year 1—capital deployment follows S-curves

4. Design stability required before automation:

- Automation requires stable, proven designs:

- Data center satellites: Design not yet finalized

- Thermal management: Still experimental

- On-orbit servicing: Unproven at scale

- Reality: Can’t automate production of satellites that don’t exist yet

- Chicken-and-egg problem: Need 100+ hand-built prototypes before automation makes sense

Real-world precedent: Tesla’s automation lesson:

Elon Musk learned hard limits of automation during Model 3 production:

| Timeline | Claim/Reality | Outcome |

|---|---|---|

| 2017 | “Alien dreadnought factory” with minimal humans | Ambitious automation vision |

| 2018 Q1 | Production hell—missed targets by 75% | Automation too complex |

| 2018 Q2 | Musk admits: “Excessive automation was a mistake” | Added humans back |

| Lesson | “Humans are underrated” | Even with unlimited capital, scaling takes years |

Source: Elon Musk Twitter/X, April 2018

Best-case timeline WITH maximum automation:

Assuming unlimited capital and perfect execution:

| Production Element | Current Rate | Max Automation Rate | Timeline to Build/Scale |

|---|---|---|---|

| Starship production | 12-24/year | 50-100/year | 3-5 years (build mega-factory) |

| Satellite production | 1,500/year | 20,000/year | 4-6 years (design + build + ramp) |

| Component suppliers | Limited | Still limited | 5-10 years (global supply chain) |

| Testing infrastructure | Bottleneck | Still bottleneck | 3-5 years (can’t speed up tests) |

Aggressive automated timeline for 1M satellites:

Even with perfect robotics and unlimited funding:

Phase 1 (2026-2030): Build automated factories—4 years

- Design mega-factories for Starships and satellites

- Construct and commission facilities

- Can’t compress below 3 years even with infinite money

Phase 2 (2030-2035): Production ramp and learning—5 years

- Inevitable learning curve: First 1,000 satellites reveal issues

- Supply chain takes time to scale globally

- Quality issues require design iterations

Phase 3 (2035-2045): Full-scale deployment—10 years

- Best-case: 100,000 satellites/year sustained

- 10,000 launches at 100 satellites each

- Assumes no major failures or redesigns

Total: 15-20 years minimum with maximum automation

Why this still beats Musk’s 2-3 year claim by 5-10x:

The fundamental constraints are:

- Time to build factories: 3-5 years (can’t be compressed)

- Component supplier scale-up: 5-10 years (global supply chain reality)

- Regulatory approvals: 2-5 years per new facility (government timelines)

- Learning curves: 3-5 years (physics of organizational learning)

Key Insight: Automation improves efficiency (2-10x gains), but can’t bypass time (still measured in decades). Even “instant” $100B investment can’t build factories, scale suppliers, and achieve regulatory approvals overnight.

The orbital debris crisis:

Current on-orbit population:

- ~9,400 active Starlink satellites

- ~12,000 total active satellites

- ~34,000 pieces of tracked debris

Adding 1 million satellites:

- 83x increase in satellite population

- Collision probability scales with density squared (Kessler Syndrome risk)

- Deorbiting requirements: With 5-7 year lifespans, 140,000-200,000 satellites must be deorbited annually at steady state

- This equals 3,800-5,400 controlled reentries per week

Physical realities no amount of money can bypass:

Unlike launch costs (which can theoretically drop with better technology), these constraints are physically hard:

- Atmospheric physics: You can’t launch through storms, and range safety requires clear weather

- Orbital mechanics: Satellites must be spaced to avoid collisions—there’s limited “parking space” even in LEO

- Regulatory jurisdiction: Environmental reviews are mandated by law and can’t be skipped

- Manufacturing learning curves: Even with unlimited capital, production ramps follow S-curves measured in years, not months

What this means for Musk’s timeline:

Even in the most optimistic scenario where:

- Starship achieves $10/kg costs immediately

- 70-flight reusability proven

- Unlimited capital available

- No technical failures

The minimum realistic timeline for 1 million satellites:

- 15-25 years accounting for regulatory approvals, manufacturing scale-up, and launch infrastructure buildout

- Not 2-3 years—that’s off by a factor of 5-10x

The practical timeline accounting for normal development delays:

- 30-40 years (mid-2050s to mid-2060s)

The more realistic vision: Musk’s “1 million satellites” is likely:

- A long-term aspirational goal (2040s-2060s), not a 2-3 year plan

- An FCC filing strategy to reserve orbital slots and frequency allocations

- A maximum authorized capacity, not an actual deployment target

A more realistic near-term goal might be:

- 10,000-50,000 satellites by 2035-2040 (still 1-5x current Starlink scale)

- 100,000-500,000 satellites by 2050 (if economically viable)

- 1 million satellites by 2060-2070 (if sustained demand exists)

Key Insight: The article correctly identifies launch costs and electricity as the economic constraints. But the physical and regulatory constraints are actually the binding limits on Musk’s timeline. Even with perfect economics, you can’t build 1 million satellites overnight—physics, manufacturing, and regulatory reality impose hard limits measured in decades, not years.

Key Takeaway: Musk’s vision is technically plausible but requires unprecedented execution across multiple simultaneous breakthroughs. The realistic timeline is mid-to-late 2030s for economic viability, but mid-2050s to 2060s for the claimed 1 million satellite scale, not 2-3 years.

Conclusion: Physics, Not Economics, Sets the Pace

The economic analysis in Part 1 showed that space-based AI infrastructure becomes viable when launch costs reach $200/kg—possibly by 2035.

But manufacturing, regulatory, and physical constraints add 10-20 years to that timeline:

The Reality Check:

- Economic viability: Mid-2030s (when launch costs hit $200/kg)

- Physical feasibility at scale: Mid-2050s to 2060s (when manufacturing can support millions of satellites)

- Musk’s 2-3 year claim: Off by 5-10x

Key Insights:

- Automation helps but doesn’t bypass time: Even with perfect robots, factories take 3-5 years to build, suppliers take 5-10 years to scale

- Regulatory reality can’t be skipped: Environmental reviews, airspace coordination, orbital slot allocation add 2-5 years per expansion

- Quality control has physical time limits: 1,000-hour test cycles can’t be compressed with more capital

- Supply chains follow S-curves: Carbon fiber, solar cells, and radiation-hardened chips can’t scale instantly

The Realistic Path Forward:

- 2026-2030: Demonstration missions (10-100 kW scale)

- 2030-2040: Economic crossover (if launch costs reach $200/kg)

- 2040-2050: Meaningful scale (10,000-50,000 satellites)

- 2050-2070: Million-satellite constellation (if demand sustains)

The Bottom Line: Musk’s vision is technically achievable and economically sound (with $200/kg launch costs). But claiming “2-3 years” ignores manufacturing reality, regulatory processes, and physical constraints that no amount of capital can bypass.

Space-based AI is coming—just not as fast as the hype suggests.

📌 Series Complete ← Back to Part 1: Economic Analysis

Want to explore the economic assumptions? Use the interactive calculator in Part 1 to test different scenarios.

Related Reading

- Part 1: Space AI Economics Reality Check - Economic viability analysis with interactive calculator

- SpaceX Starship environmental impact: FAA Federal Register

- Google Project Suncatcher: Research Blog

- Starcloud orbital data centers: Y Combinator